Is paradise really as expensive as they say? The Aloha State consistently ranks as one of the most, if not the most, expensive places to live in the United States, and this has significant consequences for its residents and the overall economy.

The allure of Hawaii its breathtaking landscapes, idyllic climate, and rich cultural heritage often masks a harsh financial reality. While tourism thrives and images of luxurious resorts dominate promotional materials, the everyday lives of many Hawaiians are defined by a constant struggle to make ends meet. The cost of living in Hawaii is significantly higher than the national average, impacting everything from housing and groceries to transportation and utilities. This disparity has far-reaching implications, including migration patterns, job market dynamics, and the overall well-being of the population.

To better understand the situation, consider the following data points, which paint a stark picture of the financial burdens faced by those who call Hawaii home. Based on available data, Hawaii's cost of living index is alarmingly high, currently standing at 168.9, although past reports have placed the index as high as 193.3, making it the most expensive state, with costs almost double the national average. This translates to exorbitant prices for essential goods and services, forcing residents to make difficult choices and often compromise their quality of life. The consumer price index in the Honolulu area, a key measure of inflation, has also been notably high, reflecting the escalating costs that directly impact consumers.

The high cost of living in Hawaii has several key drivers, each contributing to the overall economic strain. The most prominent factor is the inflated housing market, fueled by limited land availability and high demand. The state's geographical isolation necessitates the import of goods, which adds substantial transportation costs and contributes to higher prices for consumer products. Furthermore, government policies, including state budget allocations, have been cited as contributing factors to the high cost of living. A combination of these elements places a considerable financial strain on individuals and families, leading many to seek more affordable living options elsewhere.

A recent study of living expenses in Hawaii revealed that a family of four can expect to spend a significant amount monthly, placing considerable strain on the household budget. Even single individuals face substantial monthly expenses, underscoring the financial challenges that residents encounter on a daily basis. Furthermore, the cost of utilities and transportation further contributes to the financial burden.

| Category | Details |

| Cost of Living Index | 168.9 (Higher than the national average) |

| Cost of Living Index (Prior Reports) | Up to 193.3 (Highest in the Nation) |

| Comparison | Almost twice the national average |

| Family of Four Estimated Monthly Costs | $7,572 |

| Single Person Estimated Monthly Costs | Significant, based on data |

| Consumer Price Index (Honolulu Area) | Increased, reflecting rising costs |

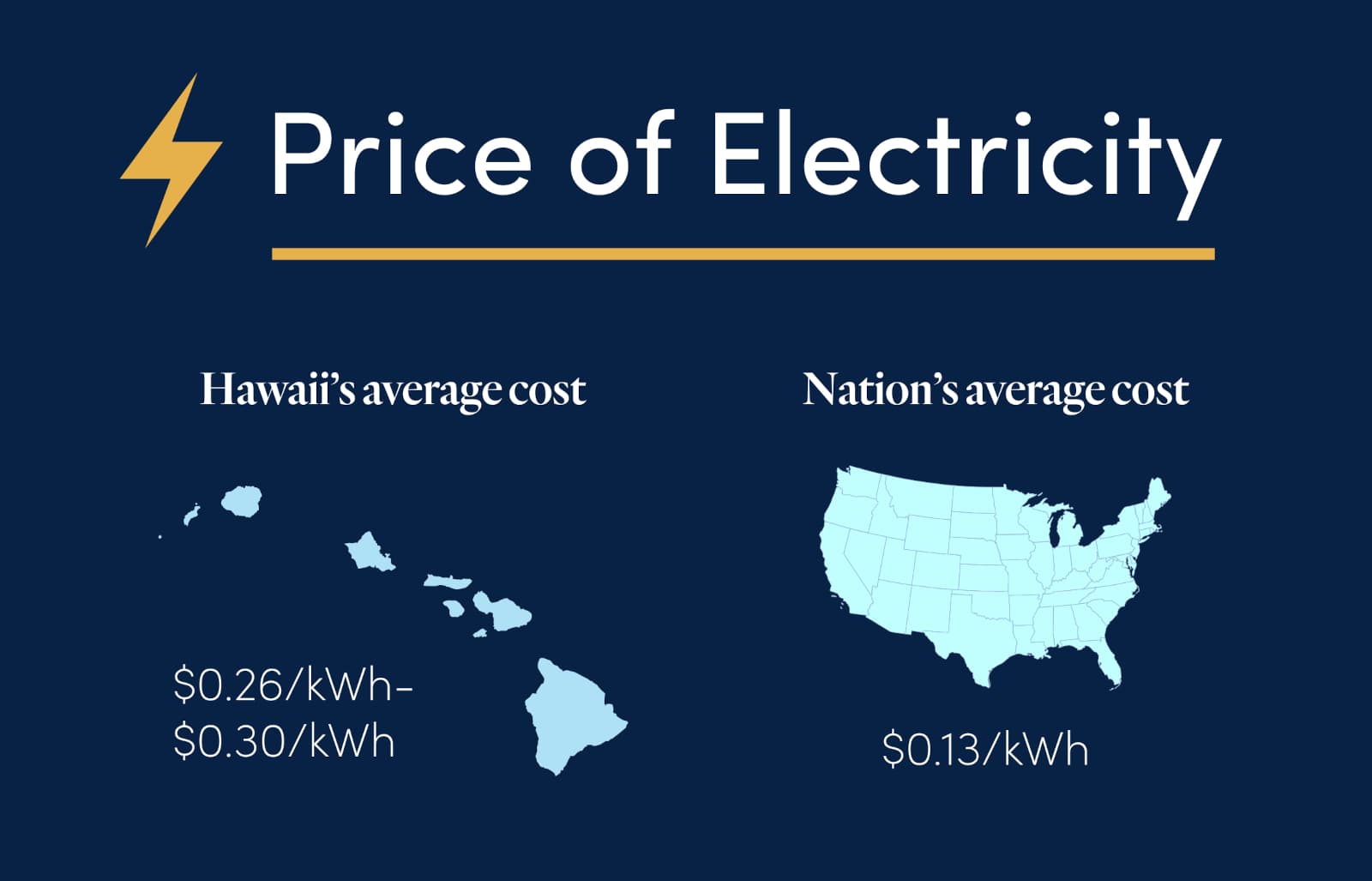

| Utilities (vs. National Average) | 42% more expensive |

| Monthly Energy Costs | Approximately $251 |

| Monthly Phone Bills | Approximately $270 |

| Gas Price Per Gallon | Approximately $4.27 |

| Primary Reasons for High Cost of Living | Poor public policy, geographic isolation, limited land availability |

The impact of Hawaii's high cost of living is evident in various aspects of island life, including migration trends. For several years, more people have been leaving Hawaii than moving in. The financial strain, coupled with limited job opportunities and a desire for a change in lifestyle, has led many residents to seek more affordable locations. This outward migration can further impact the local economy, potentially creating labor shortages and hindering economic growth. The high cost of housing, limited job market and desire for change, push people away, this further influences the dynamics of labor market and overall economy.

Several factors contribute to the high costs that Hawaiians grapple with daily. The state's isolation necessitates reliance on imports for a significant portion of its goods, adding transportation costs. This increased cost is then passed on to consumers. High demand for housing, coupled with limited land availability, has created an inflated real estate market, making homeownership or even renting exceptionally expensive. The state's geographical constraints and dependence on imports make it particularly vulnerable to fluctuations in global markets, leading to price instability for essential commodities.

The state's economic policies, including budgetary allocations, also play a role in shaping the cost of living landscape. A high state budget per capita reflects the government's spending priorities and their impact on the financial burdens faced by residents. The government's role in infrastructure, taxation, and regulation can either exacerbate or mitigate the cost of living. The complex interplay of economic forces and government policies shapes the financial realities of people living in Hawaii.

In January 2022, the consumer price index surged 7.5% on an annual basis, marking the highest increase in about 40 years. The increase indicates the rise in the cost of goods and services, which has particularly affected Hawaii. The continuous increase in the consumer price index places additional financial strain on residents, as they are faced with rising prices for essential items like food, fuel, and other necessities. This inflation further exacerbates the existing challenges associated with the high cost of living in Hawaii.

The high cost of living impacts the residents of Hawaii in many ways, including the quality of life. The residents of Hawaii spend a considerable amount of their income on basic needs, leaving them with less disposable income for discretionary spending or saving. This can limit their access to essential services, such as healthcare, education, and leisure activities. The economic stress can affect physical and mental well-being, leading to increased stress levels and a reduced quality of life. The financial struggles experienced by many residents often lead to tough choices and compromises on their standard of living.

For federal employees, the cost of living is addressed through pay differentials and cost of living indexes. These adjustments are designed to offset the financial impact of living in a high-cost area. The use of pay differentials and cost of living allowances is vital in maintaining the financial stability of federal employees living and working in Hawaii. The cost of living allowance indexes for military personnel stationed in Hawaii are also used to ensure that they can maintain their living standards. Moreover, location codes are required to compute allowances and aid service members.

The concept of affordable housing is a growing concern for Hawaiis population. Limited availability and high costs make it a challenge for residents. The lack of affordable housing means that a significant number of residents barely make ends meet, which contributes to social and economic strains. The issue of affordable housing is complex, touching upon zoning, development regulations, and financial incentives.

The disparity between the cost of living and the median income levels presents a significant challenge for the residents of Hawaii. The high cost of living, which includes housing, food, and transportation expenses, often surpasses the income earned, placing economic strain on households. The lack of affordable housing, coupled with high expenses, means that a large percentage of residents are forced to allocate a substantial portion of their income to basic needs, leading to financial difficulties. Furthermore, limited job opportunities and salaries can make it difficult for individuals and families to keep up with the increasing costs of living.

Several factors can be considered as potential solutions to combat the high cost of living. Efforts to expand the availability of affordable housing units through different strategies, such as construction incentives, zoning reforms, and promoting innovative housing solutions, can offer relief to residents. Promoting economic diversification by encouraging growth in new industries, such as technology and renewable energy, can create more job opportunities and enhance earning potential. Addressing the cost of imports through supply chain optimization and exploring local production of goods, such as agriculture, can help reduce consumer costs. By implementing a combination of effective policies and initiatives, Hawaii can begin to make the cost of living manageable for all of its residents.

The economic factors, combined with the high cost of housing, transportation, and utilities, have significant consequences for the population. The economic challenges, including inflation, make Hawaii an expensive place to live, and residents are forced to make difficult financial decisions. These costs impact the local economy and society, as people struggle to maintain their living standards and financial stability. The economic environment and the difficulties in finding affordable housing are driving people to look elsewhere. The ongoing situation shows the need for reforms to improve the quality of life for all residents.